Two years ago, I wrote an Euroconstruct briefing about the bright future that was expected for Swedish infrastructure. As of February 2026, the market surge has clearly materialized, with strong growth now firmly underway.

Due to Sweden’s elongated shape, measuring 1600 kilometers from the north to the south, and 500 kilometers from the west to the east, the demand for roads and railways is significantly higher than in many other European countries. In addition, the Swedish mining, steel and forest industries which are mainly located in the north constitute a significant part of GDP and exports, creating huge demands for reliable transports. Even so, most roads and railways in Sweden was constructed long ago but in general has not been maintained very well. Consequently, after decades of far too low investments and a continuously increasing maintenance debt, current demand widely exceeds actual investment levels.

Swedish infrastructure policy in light of a growing European focus

Over the past years, the issue of infrastructure has increasingly come into focus within a European context. Prolonged structural underinvestment has led to significant problems that hinder productivity development and collectively set Europe back in economic development, especially compared to the US and Asia. This has sparked a new wave of discussions and political initiatives aimed at addressing these deficiencies and creating conditions for faster socio-economic development. Particularly in Germany, historical decisions on extensive infrastructure investments have marked this new direction. But there are also critics that argue that in the end, there will not be as much money allocated to the civil engineering market as the German politicians claim.

In Sweden, the new government infrastructure plan for the years 2026-2037 is the largest ever and represents a real-term increase of 27% compared with its predecessor. It also contains formulations that open for alternative financing solutions, with the aim of speeding up investments where market conditions allow for quicker action than what the traditional state bureaucracy has allowed. The Malmbanan railway in the north is a clear example where significant economic interests are at stake, but recurring problems have not yet been addressed rapidly enough by the public sector.

At the same time, extensive investigation and legislative work is taking place in energy policy to create the right conditions for the electrification needed in the transition towards a more sustainable society. Thanks to the new green industries, Sweden has several competitive advantages that position us well on an international level. However, a significant increase in electricity production is required as usage is expected to rise sharply. Stability in electricity prices must also be ensured to avoid becoming a limiting factor. Despite long-term investments in, for example nuclear power and wind power, the short-term effects are still relatively limited.

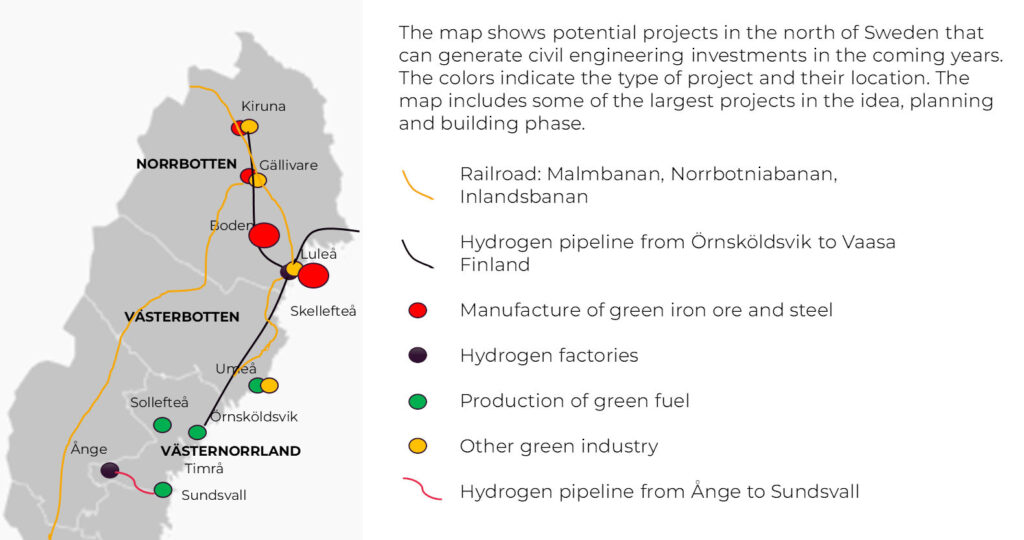

Figure 1: Map of potential Swedish civil engineering projects

Source: Prognoscentret (2026).

ABOUT THE AUTHOR

Mårten Pappila

Prognoscentret AB

Mårten Pappila is construction market analyst at Prognoscentret which is the Swedish member in Euroconstruct. Mårten has a Master's degree in Economics from the Gothenburg School of Economics. He has a broad experience from the government sector including national accounts, financial statistics and labor market analysis.

Rising financing costs in line with higher long-term interest rates

Infrastructure investment is largely publicly financed and has become more challenging as long-term interest rates have risen. Across Western economies, governments face a combination of rising investment needs and weaker bond market conditions. Greater reliance on debt financing has expanded government bond issuance, pushing yields higher and increasing interest expenses, which in turn reduces fiscal space.

Sweden’s public finances remain strong due to its long-standing surplus target. In autumn 2024, a new fiscal framework was agreed for 2027–2034, replacing the surplus target with a balanced budget target while keeping the debt anchor unchanged. This change is expected to free up around SEK 200 billion over eight years.

Despite this, the agreement has faced criticism from both employer and trade union organizations, as well as from the municipal sector, which argues that the state should assume greater responsibility for infrastructure investment. Several economists have also called for a more proactive fiscal policy to ensure that necessary investments are made.

Overall, even with the abolition of the surplus target, financing constraints are likely to persist, and infrastructure investment risks remaining below actual needs. This is the case despite Sweden’s strong public finances and comparatively low long-term interest rates, highlighting that financing costs are rising even for Sweden.

Major investments in Swedish infrastructure through 2028

Since 2023, both investments as well as renovation and maintenance have steadily increased in the Swedish civil engineering market, indicating that this market is not as sensitive to economic cycles as new construction and renovations of residential and commercial properties. This is largely because the majority of financing comes from the public sector or from fees in a monopolistic market. Strong public finances allow Sweden to both build new infrastructure and pay off maintenance debts, even though construction costs have increased significantly in recent years.

After years of deferred maintenance and mounting structural strain, Sweden has entered a new era of infrastructure focus. Worn-out roads, congested railways, and aging water and sewage systems have created a maintenance backlog that can no longer be ignored. Combined with rising demands from defense, climate transition, and industrial expansion, these pressures are now driving an unprecedented wave of public investment. Activity is now increasing across virtually all infrastructure segments at the same time.

“The Swedish civil engineering market is in a strong recovery phase after the 2022 downturn”

At the core of this surge lies the accumulated maintenance debt. Roads, railways, and water systems across the country have reached, or are approaching, the end of their technical lifespans. Reinvestment is no longer optional; it has become a necessity. At the same time, entirely new infrastructure is being built to meet future needs.

Road maintenance stands out as the fastest-growing segment. Prognoscentret estimates that road maintenance spending will increase by 30% in real terms between 2025 and 2028. This is an exceptionally high rate by historical standards.

Railway infrastructure is also receiving a major boost. Sweden’s new national transport plan includes substantial funding for both new rail construction and reinvestment in existing lines. Flagship projects such as the Ostlänken high-speed line, the Norrbotniabanan, and upgrades to the Malmbanan freight corridor are central components. However, capacity constraints remain a challenge, as the rail construction market is relatively small and productivity must improve to fully realize the ambitions of the plan.

Higher fees in water and energy systems further strengthen funding capacity and boost investments in electricity grid networks as well as both water treatment plants and pipelines.

Security policy considerations add further momentum. Defense-related construction has roughly doubled in just a few years, and Sweden’s NATO membership is expected to drive additional investment in east–west transport corridors. Climate adaptation, electrification, and northern Sweden’s green industrialization are also acting as long-term growth engines.

Despite the positive outlook, risks remain. Procurement disputes, labor shortages, limited contractor capacity, and lengthy permitting processes continue to pose challenges. At the same time, similar infrastructure booms across Europe are intensifying competition for skills and resources.

Looking ahead, increased private financing is increasingly discussed as a complement to public investment, potentially pushing infrastructure growth even higher.

ABOUT THE AUTHOR

Mårten Pappila

Prognoscentret AB

Mårten Pappila is construction market analyst at Prognoscentret which is the Swedish member in Euroconstruct. Mårten has a Master's degree in Economics from the Gothenburg School of Economics. He has a broad experience from the government sector including national accounts, financial statistics and labor market analysis.