ABOUT THE AUTHOR

Arthur Cluet

BDO Advisory

Arthur Cluet is a Director at BDO Advisory France, where he plays a key role in guiding clients through complex strategic and financial challenges. With a background in finance, economic analysis and data science, Arthur has previously held roles at BIPE (a French strategy consulting firm), Natixis AM and AssetFI MS (a French investment boutique). Arthur has contributed to various commercial due diligence, strategic plan, and market study, mostly for infrastructure, construction, and real estate businesses. Arthur also has interest in sustainability professionally and personally.

European construction set for gradual recovery after a two-year decline

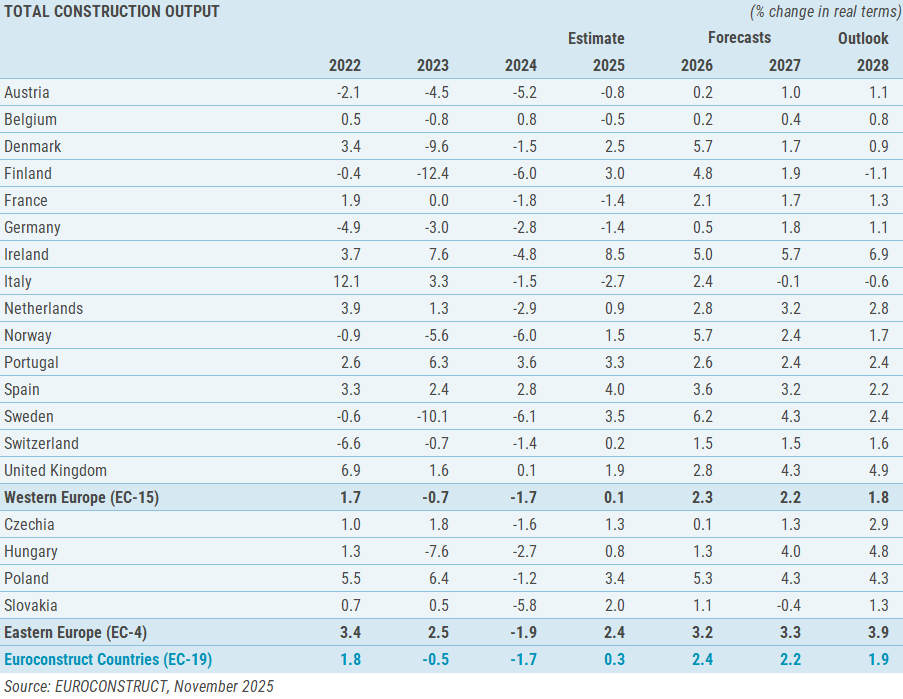

Paris, France – November 25, 2025 – After two consecutive years of contraction, Europe’s construction sector is entering a phase of cautious stabilisation. According to the latest November 2025 forecast from the Euroconstruct network, total construction output across the 19 member countries declined by 0.5% in 2023 and by 1.7% in 2024, marking the weakest two-year performance since the pandemic. Yet the outlook is shifting: modest growth of +0.3% is expected in 2025, followed by a more noticeable expansion of +2.4% in 2026 as financing conditions ease and civil engineering becomes the main engine of recovery.

Economic fundamentals remain mixed. While interest rates have retreated from their 2023 peaks and inflation has moderated across Europe, construction activity continues to face strong headwinds: high building costs, affordability constraints, subdued private investment and persistent macroeconomic uncertainty. These pressures weigh most heavily on building construction, particularly the residential segment.

Residential construction remains the primary drag on overall growth. New residential output dropped in 2023 and in 2024. A genuine rebound will materialise only in 2027. Residential renovation, also softened in 2024, and is expected to decline again in 2025 before returning to modest growth in the following years. This confirms a structural pattern: renovation remains resilient but no longer delivers the strong counter-cyclical support seen during the energy-efficiency boom of earlier years.

The non-residential sector is performing somewhat better. After a small contraction in 2024, growth will return in 2025, accelerating in 2025 in 2026. The composition of demand, however, is changing. New non-residential construction is revised downward in 2025, reflecting cooling demand in commercial, industrial and logistics facilities amid slower economic momentum. Renovation for non-residential buildings remains the foundation of the sector, rising in 2025 and in 2026, supported by energy-performance requirements and the upgrading of ageing public and private facilities.

By contrast, civil engineering remains the strongest and most stable component of the European construction cycle. After growing in 2023 and in 2024, the sector is forecast to expand in 2026, with both new infrastructure and renovation contributing. New civil engineering work is projected to grow, while renovation records a solid growth through 2028. The sector is set to stand really above 2023 levels by 2026, driven by transport investment, energy-transition infrastructure, climate adaptation and EU-funded programmes.

National trajectories remain highly heterogeneous. Only four countries – Ireland, Poland, Sweden, and the United Kingdom – will exceed 4% annualised growth between 2026 and 2028. Among major economies, Spain shows solid prospects with 3.0% growth, while France and Germany remain subdued at 1.7% and 1.1%. Italy grows only 0.6%, despite a significant upward revision from earlier expectations. At the lower end, Belgium (0.5%) continues to face stagnation.

Ireland stands out as the fastest-growing market through 2028, supported by strong public investment and resilient demand. Poland also posts strong medium-term growth despite downward revisions, while Spain and Portugal benefit from broad-based expansion in both building and civil engineering. In contrast, Germany, Austria, France and Italy face continued headwinds due to weak residential demand, high costs and constrained financing.

One of the clearest outcomes of the November 2025 forecast is a shift in the composition of growth: new construction and civil engineering will increasingly drive the cycle from 2025 onwards, while renovation –still stable – enters a phase of lower expansion as fiscal constraints tighten and major subsidy programmes are scaled back. Total construction output will exceed 2023 levels by 2027, although the recovery remains uneven and sensitive to ongoing economic uncertainty.

Overall, the Euroconstruct network forecasts a gradual recovery. The combination of improving financial conditions, long-term infrastructure programmes and sustained renovation demand should help stabilise the sector in 2025 and support broader growth from 2026 onward.

Table 1: Evolution of construction output in the EUROCONSTRUCT 19 area

S: EUROCONSTRUCT (November 2025). – 100th Conference.

EUROCONSTRUCT forecasts available for purchase

All our analyses and forecasts are published in our reports – the EUROCONSTRUCT Country Report and the EUROCONSTRUCT Summary Report. Read more

About EUROCONSTRUCT

The 100th EUROCONSTRUCT-Conference was held in Paris on 25 November 2025, hosted by BDO France.

EUROCONSTRUCT was founded in 1975 by specialised research organisations from France, Germany, Italy, the Netherlands and the United Kingdom as a study group for construction analysis and forecasting. It has since expanded from this core group to include almost all Western European countries and four Central Eastern European countries. Currently, EUROCONSTRUCT has member institutes in 19 European countries.

The objective of EUROCONSTRUCT is to provide information, analysis and forecasts to decision-makers in the construction sector and other markets related to the construction industry, to enable them to plan their business better and more effectively. The activities of the EUROCONSTRUCT network are also aimed at official institutions such as ministries or agencies, as well as national and international associations.

ABOUT THE AUTHOR

Arthur Cluet

BDO Advisory

Arthur Cluet is a Director at BDO Advisory France, where he plays a key role in guiding clients through complex strategic and financial challenges. With a background in finance, economic analysis and data science, Arthur has previously held roles at BIPE (a French strategy consulting firm), Natixis AM and AssetFI MS (a French investment boutique). Arthur has contributed to various commercial due diligence, strategic plan, and market study, mostly for infrastructure, construction, and real estate businesses. Arthur also has interest in sustainability professionally and personally.