The new objectives of the European Commission in terms of energy performance of buildings have led BDO-BIPE to build a forecasting model to 2050 for the EPC of buildings. The following article describes this approach and analyses its results for France and Italy highlighting the differences between the two countries.

Based on European and national policies and targets on the energy performance of buildings, BDO-BIPE has developed a method for forecasting the stock’s distribution of energy performance certificates (EPC) for buildings by 2050.

In order to show the results of this original method, this article will describe the European framework for energy renovation (I). It will then study the current situation of the buildings’ energy performance in France and Italy (II). Finally, according to the method developed by BDO-BIPE, it will present the EPC distribution’s potential evolution in these two countries in order to reach the Commission’s objectives (III).

The European Framework

On last December 15th, the European Commission proposed a new directive on the energy performance of buildings – 2021/0426 (COD). This directive is part of the Commission’s “Fit for 55” proposals as it complements the other components of the package adopted in July 2021. As for the Commission, this proposal sets the vision for achieving a zero-emission building stock by 20501. The institution reminds that this proposal is a key element to achieve the 2030 and 2050 decarbonisation objectives as buildings account for 40% of the energy consumed in the EU and 36% of energy-related greenhouse gas emissions; heating, cooling and domestic hot water are responsible for 80% of the energy that households consume.

The Commission proposal therefore aims to facilitate the renovation of the building stock and to encourage the construction of new zero-emission buildings. For instance, the text proposes that as of 2030, all new buildings must be zero-emission – as of 2027 for new public buildings – and that the worst-performing 15% of the building stock of each Member State to be upgraded from the Energy Performance Certificate’s Grade G to at least Grade F by 2027 for non-residential buildings and 2030 for residential buildings.

In addition to this general frame, all the EU Member States published a long term renovation strategy2. Those national strategies are supposed to implement the European strategy by supporting the renovation of their national building stock into a highly energy-efficient and decarbonised building stock by 2050.

For instance, the French national strategy plans to act around four objectives3:

- Support households to help them renovate their homes and thus combat fuel poverty and thermal flats as a priority;

- Accelerate renovation in tertiary buildings with the aim of making public buildings exemplary in this area (15% energy savings expected between 2017 and 2022 for the State’s building stock);

- Mobilise and involve the territories and local players;

- Create a dynamic industry to renovate more, better and cheaper.

Their implementation involves the use of 14 billion euros of public support in the form of investments and bonuses, supplemented by more than 5 billion euros of energy saving certificates used directly to finance energy renovation work.

In the same vein, the Italian plan relies heavily on the renovation of public buildings and incentives for households through tax measures. For example, the “Superbonus” provides for a tax deduction of up to 110% to be offered to homeowners on expenses related to energy upgrades and seismic risk reduction4.

The energy performance of the French and Italian building stock

The study of the French and Italian building stocks and their energy performance certificates illustrates the different renovation needs that different EU member states may have.

The study of the structure of the French and Italian building stocks shows similarities for residential and non-residential buildings. For example, in both cases more than 60% of the buildings were built before 1989. French residential buildings built from the 2000s onwards constitute a larger share of the stock than in Italy – 27% in France, 22% in Italy. This observation can be reversed for non-residential building stock – 25% in Italy, 18% in France.

Considering the energy consumption of the residential sector, 59% of the French EPC stock is composed of A to D certificates compared to 22% of the Italian stock. In France, 17% of the EPC stock is composed of F and G certificates compared to 61% in Italy. The renovation effort will therefore have to be greater in Italy than in France to achieve the Commission’s objectives.

The observation is similar for non-residential buildings for which 62% of the French stock is between A and D versus 42% of the Italian stock.

Methodology and output

BDO BIPE has developed a model to forecast the stock by energy performance certificate (EPC) to 2050 per country and type of building, by integrating the European Commission’s directives on the levels of energy renovation work.

The parameters for calibrating the EPC stock structure are, in addition to renovation, new buildings, the EPC stock structure and demolitions. The mathematical model is as follows:

\[DistribPEC_t^i= DistribPEC_{t-1}^i+NewBuildingsImpact_t^i+RenovationImpact_t^i+DemolitionImpact_t^i.\]

Currently, the model implements three type of scenarios:

- Zero transition: all parameters are fixed with the last known value. The energetic renovation has a null effect on the EPC distribution and new buildings EPC distribution is the last known.

- Delayed transition: Time-lagged steps compared to the European Commission’s directives

- Orderly transition: an orderly transition is happening starting in 2020. New construction consumes less energy through time and renovation follows the European Commission objectives.

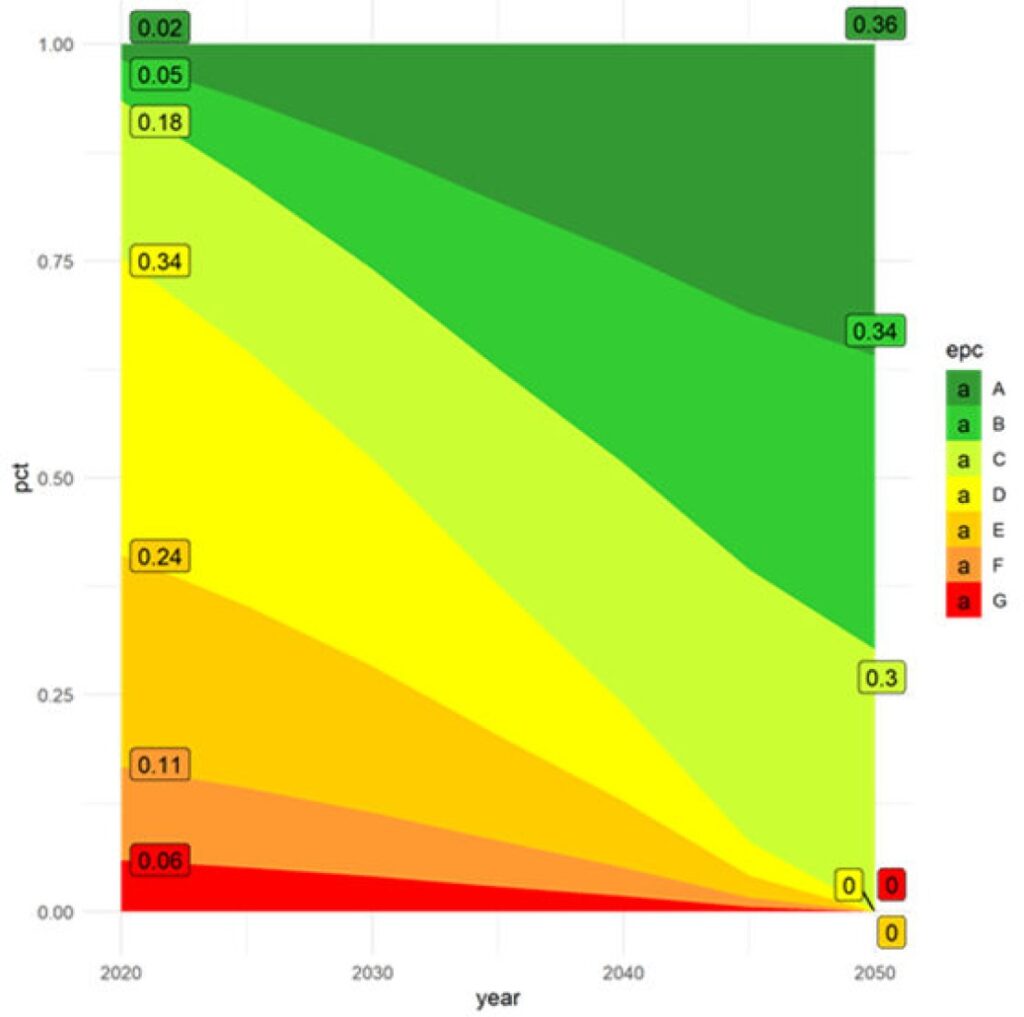

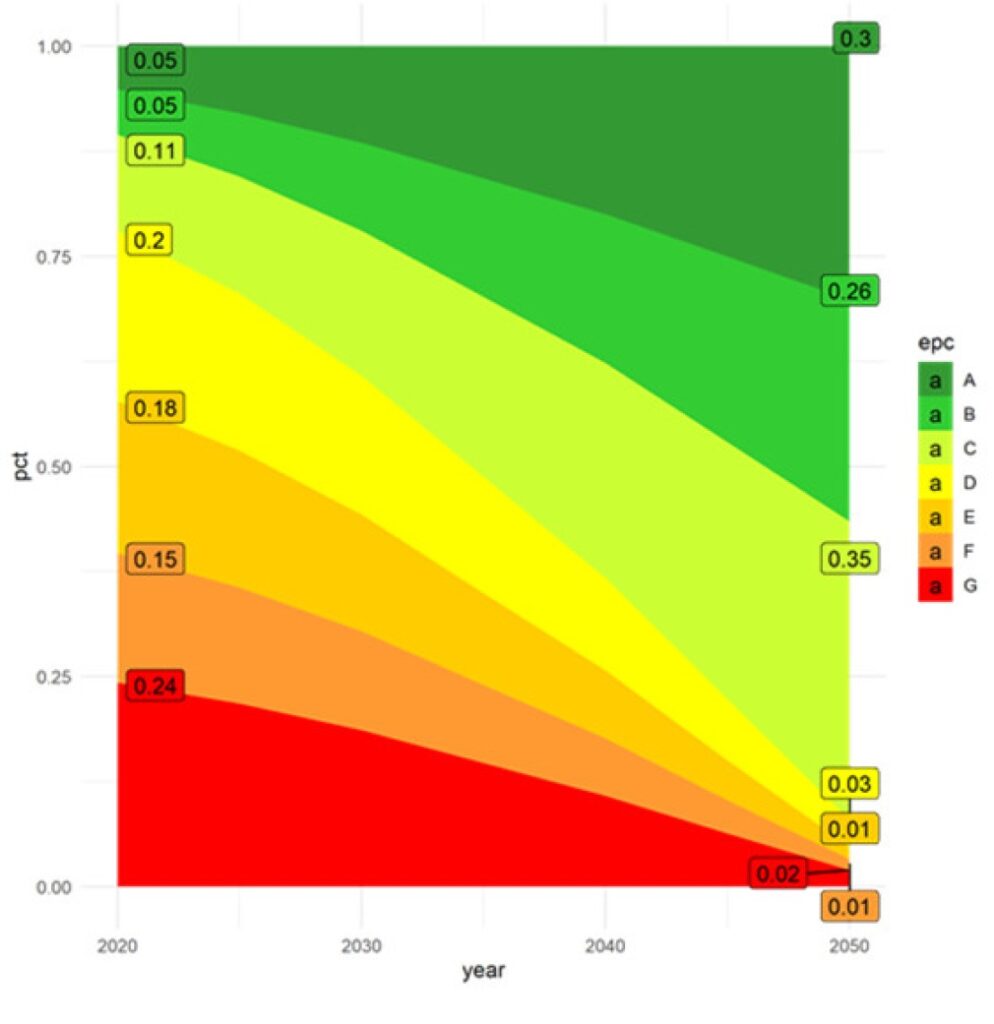

As a result, BDO-BIPE model’s shows the evolution of the stock by type of buildings & energy performance certificate (EPC) and by scenarios by 2050 per country. The following graphs show the results for the French residential buildings and the Italian non-residential buildings for the orderly transition scenario.

French residential – orderly transition

Italien non-residential – orderly transition

These two graphs show that depending on the current state of the stock – its age and energy performance – the Commission’s targets will be more or less difficult to achieve.

For example, by 2050, the French residential stock should be 100% EPC A to D. The Italian non-residential stock should retain a slight proportion of EPC E to G – 7%.

ABOUT THE AUTHOR

Pascal Marlier

BDO Advisory

Graduated engineer, Pascal joined BDO-BIPE in 1998 and is in charge of B2B sectors including Construction, Real Estate, Energy, Environment and Financial Services. He has led a number of assignments in the construction sector, notably in the field of housing, renovation, financing, etc. He has been trained in the carbon footprint method.

Footnotes

1 https://ec.europa.eu/commission/presscorner/detail/en/ip_21_6683

2 https://energy.ec.europa.eu/topics/energy-efficiency/energy-efficient-buildings/long-term-renovation-strategies_en

3 https://www.ecologie.gouv.fr/plan-renovation-energetique-des-batiments

4 https://www.governo.it/sites/governo.it/files/PNRR_0.pdf

ABOUT THE AUTHOR

Pascal Marlier

BDO Advisory

Graduated engineer, Pascal joined BDO-BIPE in 1998 and is in charge of B2B sectors including Construction, Real Estate, Energy, Environment and Financial Services. He has led a number of assignments in the construction sector, notably in the field of housing, renovation, financing, etc. He has been trained in the carbon footprint method.